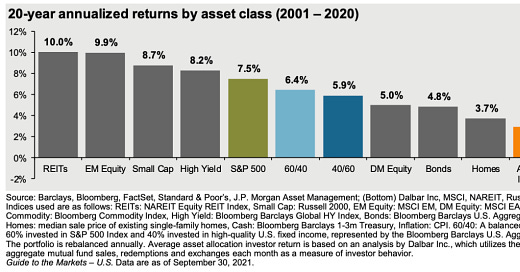

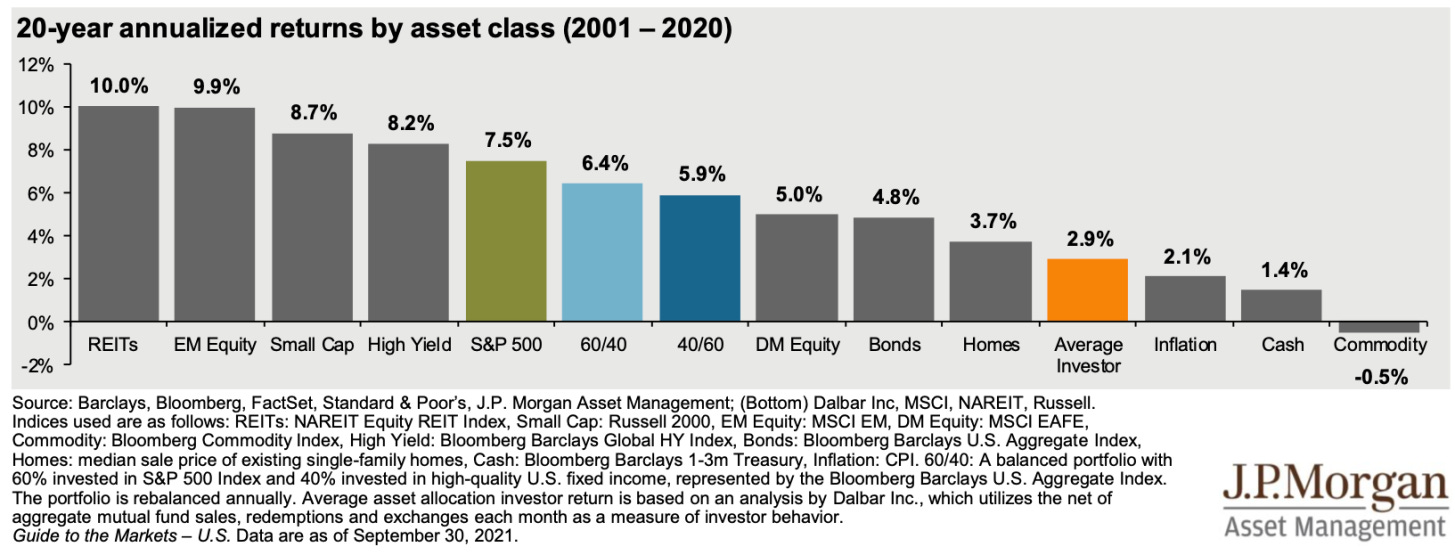

I came across a research by J.P. Morgan Asset Management a while back that startled me.

The research compared various asset types, markets - real estate, US stocks, bonds, Emerging Market stocks.

It even compared different portfolio compositions - 60% stocks & 40% bonds, 40% stocks & 60% bonds.

They put everything on 1 chart to make it easy to compare.

Take a look below:

S&P 500 averaged around 7.5% per year (annualized) and real estate averaged around 10% per year (annualized).

That didn't surprise me.

As someone who has been investing in real estate for 15 years, I’ve seen how much real estate went up over the years.

Granted, in the past 1-2 years, some real estate markets softened or corrected.

If you zoom out to see the longer term trend, anyone who has invested in real estate in the past 20 years have done really, REALLY well.

.

What surprised me?

The average return of an “Average Investor”…

2.9%

That’s a bit lower than I had imagined.

I would have guessed around 4-5%

Why is it so low?

It’s because of human emotions.

The “Average Investor” are at the mercy of their emotions.

Allow me to explain why that’s normal and why many people are affected by their emotions when it comes to investing.

.

It’s normal because of human behaviors that have been programmed into our brain from our ancestor cavemen or cave women.

It has everything to do with our desire to feel safe.

We have all heard of the herd mentality:

The tendency for people's behavior or beliefs to conform to those of the group to which they belong.

Have you ever considered WHY?

It’s because of our desire to feel safe.

.

In the days of our ancestors, living in the wild exposed them to all kinds of danger.

The best way to protect oneself is to BE in the middle of everyone else.

If there’s any potential threat, whoever is on the outside of the group would be hurt first.

Whether we like it or not, this has been programmed into our DNA for thousands of years.

What used to serve us and protect us to help us survive, doesn’t work when it comes to investing.

When it comes to investing:

What helps us survive actually hurts us.

.

Investing is all about willing to take action when others are waiting.

It’s about seeing the opportunity on the horizon and be willing to do what others won’t do.

This sounds scary at first.

Yet it makes perfect sense.

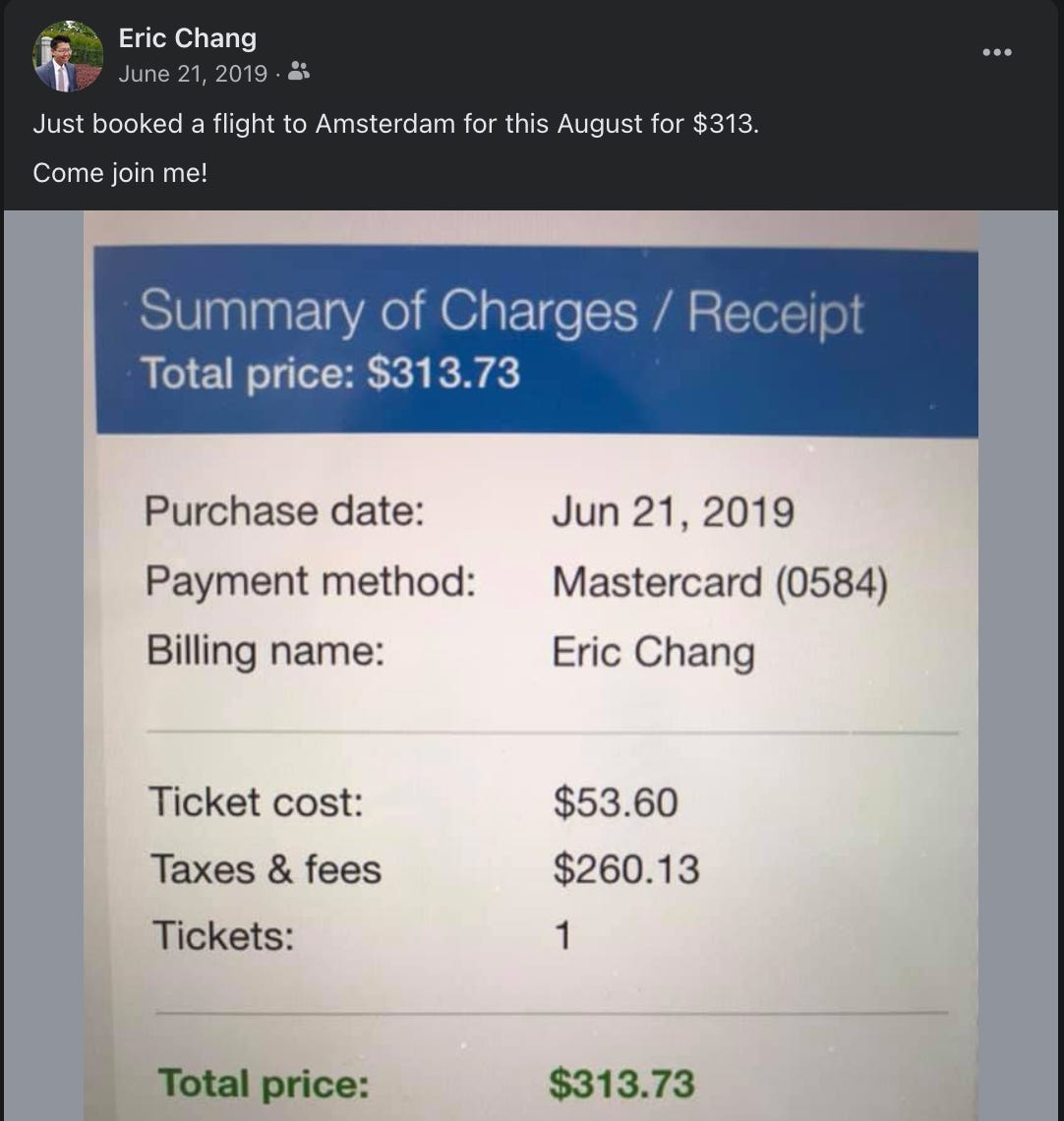

Think about the time you found a great deal on something.

Let’s say you found a round trip plane ticket to go to Amsterdam for only ~$300.

You can wait to ask around to make sure the airline is in a good financial situation that they won’t go shut down before your flights.

You can wait to ask around if anyone can go travel with you.

You can wait to ask around what you could do in Amsterdam…

Or, you can jump on it and grab the deal before it was gone.

.

Best opportunities don’t wait around forever.

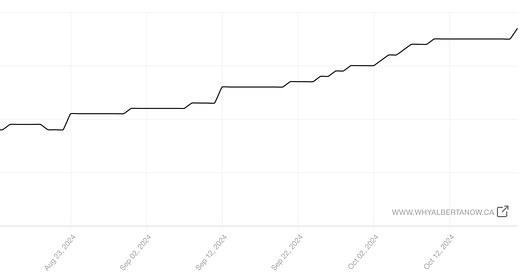

For example, at the end of last year, we were seeing many single family properties in Edmonton selling at a fair price.

To us, it was a steal!

Because we know the zoning bylaw will be changing to allow single family lot of a certain size to be developed into a small multi family building without the need to go through rezoning.

That was a big deal.

Rezoning takes time, and there’s always a chance to run into challenges during the rezoning process and delay the project.

Now that a huge challenge was removed.

Knowing that information, we know the price for these lots will be going up up up in the coming months.

Instead of waiting around, we jumped on it.

Let just say, we bought a lot of lots (yes, insert Dad jokes here)

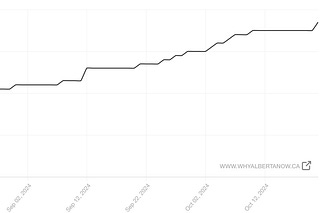

In short few months, many of these lots have all gone up by 30-50k. With a few gone up even more.

If we hesitated and waited for the crowd to act, we would have missed out hundreds of thousands in gains in just a short few months.

.

That plane trip to Amsterdam? I booked it for $313 round trip. That price was gone within few hours.

If I had waited, I would have missed out on an amazing trip of cycling across a beautiful country.

Have you missed out on actions in the past?

Reply to this email and share with us your story

Eric Chang

Calgary, AB

September 10, 2024

Copyright © 2024 Why Alberta Now.

No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law.

The information provided herein is believed to be accurate and reliable, but Why Alberta Now does not guarantee its accuracy or completeness. The content is for informational purposes only and is not intended to be a substitute for professional financial advice. Why Alberta Now is not a financial advisor and does not provide personalized financial advice. The views and opinions expressed in this publication are those of the author and do not necessarily reflect the official policy or position of Why Alberta Now. The content may be subject to change without notice and may become outdated over time. Why Alberta Now is under no obligation to update or revise any information presented herein.

Investments involve risks, and individuals should consult with a qualified financial advisor before making any investment decisions. Prospective investors should carefully consider the investment objectives, risks, charges, and expenses of any investment before investing.